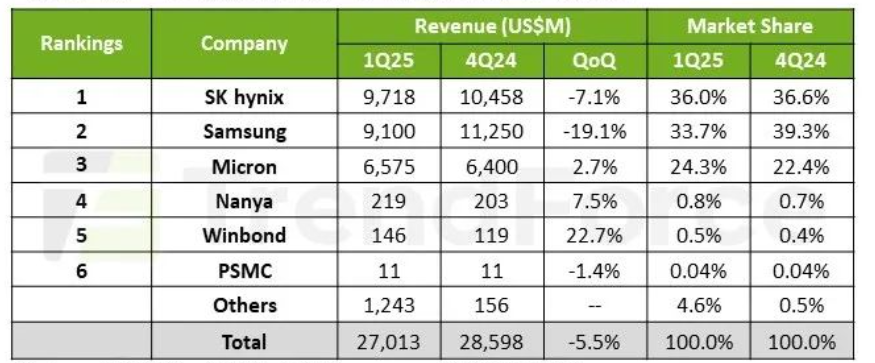

According to the survey, the DRAM industry revenue in the first quarter of 2025 was US$27.01 billion, a quarterly decrease of 5.5%. The main reasons are the decline in the contract price of conventional DRAM and the shrinking scale of HBM shipments.

In terms of average selling price, due to Samsung's change in HBM3e product design, the HBM capacity crowding-out effect has weakened, causing the contract prices of most products to continue the downward trend since the fourth quarter of 2024.

The following table shows the memory revenue ranking of global DRAM manufacturers in the first quarter of 2025:

Looking ahead to the second quarter of 2025, as PC OEMs and smartphone manufacturers gradually complete inventory liquidation and actively produce complete machines, the momentum of bit procurement will increase, and the number of bits shipped by original equipment manufacturers will increase significantly quarter-on-quarter.